Greece’s Return to the Headlines

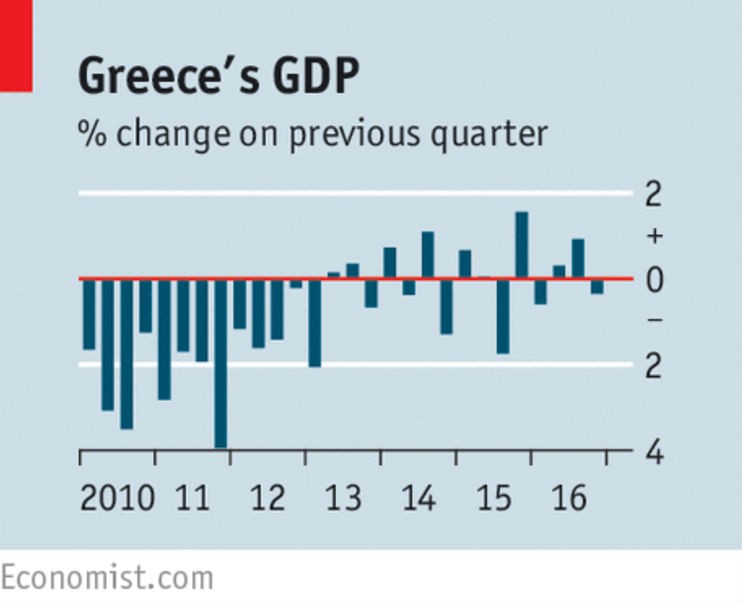

As you can see from the graph, the nation of Greece, once the subject of almost daily speculation about the viability of its government bonds, has pulled its economy out of a disaster into a muddle. No doubt, you got tired of hearing about Grexit scenarios and all the times when the European Central Bank and the European Stability Mechanism came to the rescue.

Today, Greek unemployment stands at an alarming 23%, yet somehow the country has eked out a budget surplus, counting debt-interest costs, of 0.5% of GDP in 2016. So the country is finally out of the woods, right? Alas, Dutch and German creditors are now demanding that the Greek budget surplus be raised up to 3.5%, a level which would certainly push the nation into depression. Meanwhile, French, Dutch and German officials are afraid that if they permit the ESM to refinance Greece bonds at lower interest rates, it would embolden anti-EU politicians and potentially break up the union.

The resulting standoff, once again, threatens a Greek default and the possibility of a Grexit. Expect to read all about it in the coming months, and experience deja vu all over again.

About the author

Athena K. Stone has been with Attentive Investment Managers, Inc. since 2003, is an Investment Advisor and the Chief Compliance Officer for the company. Mrs. Stone earned her Chartered Retirement Planning Counselor (CRPC) designation in 2010 from the College for Financial Planning. She received the designation of Accredited Investment Fiduciary (AIF) from Fi360 in 2011. She earned her Bachelor of Arts Degree in Organizational Leadership from Brandman University in 2012 and her Master of Science in Financial Planning and Designation of MPAS (Master Planner Advanced Studies) from the College for Financial Planning in 2018.

By accepting you will be accessing a service provided by a third-party external to https://www.attentiveinv.com/

Comments