Your Financial Pyramid

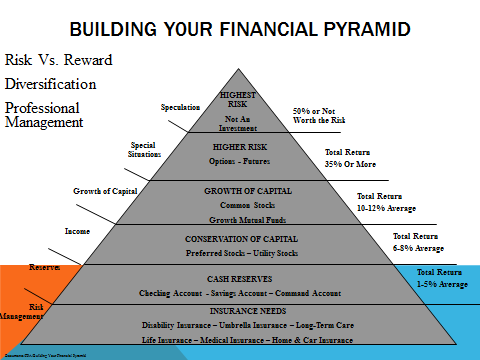

When you develop your Financial Pyramid there are numerous factors that you need to be mindful of. One of the most important is the concepts of managing your risk versus reward and diversification. With this in mind it is of critical importance that you start off with a good financial base which mitigates your risks.

Insurance needs, including medical, home & car insurance (just to name a few) are imperative for protecting your assets from unforeseen loss. As an example of how this can affect your Financial Pyramid and your overall budget, we once had a client whom had drastically cut their annual budget expenditures. After further inspection, we discovered they had cancelled their medical insurance – thinking that they were young and healthy; they didn't need to be concerned with that "unneeded" expense. At that point, we advised them to immediately reinstate their insurance. They had saved up a large nest egg which they intended to invest in the stock market. After a couple of weeks and no contact with the client, we followed up with them and found that a couple days after our meeting they had fallen off a roof and landed themselves in the hospital with severe injuries. With no insurance the funds that they had had earmarked for investment was now going to be used to pay hefty medical expenses.

Likewise, building a strong secondary base through accumulating healthy reserves of cash in checking and savings will provide you with emergency funds to cover living expenses should you lose a job or are in need of a major vehicle repair. Let's be honest, life 'happens' – things come up and whether we like it or not we must be prepared so that we don't create unnecessary hardship on your monthly budget & finances.

Once you build a healthy base for your Financial Pyramid, one can begin focusing on conservation of capital and building wealth. Naturally, the more wealth you build the more aggressive you can become within the range of the types of investment strategies you can utilize. This is where we as Investment Advisors and Financial Planners can play a vital role in guiding you into appropriate investments that coincide with needs and goals.

About the author

Athena K. Stone has been with Attentive Investment Managers, Inc. since 2003, is an Investment Advisor and the Chief Compliance Officer for the company. Mrs. Stone earned her Chartered Retirement Planning Counselor (CRPC) designation in 2010 from the College for Financial Planning. She received the designation of Accredited Investment Fiduciary (AIF) from Fi360 in 2011. She earned her Bachelor of Arts Degree in Organizational Leadership from Brandman University in 2012 and her Master of Science in Financial Planning and Designation of MPAS (Master Planner Advanced Studies) from the College for Financial Planning in 2018.

By accepting you will be accessing a service provided by a third-party external to https://www.attentiveinv.com/

Comments